Every book town has the bookstore. The singular institution run by a bookseller with decades of experience. You need to prepare yourself for such places. Fortify yourself to sustain your focus for as long as possible. But, as you wend between the stacks, extracting volumes with a care akin to disarming an explosive: what will become of all these books? What’s the owner’s exit strategy?

In some cases, there’s a daughter, son, or assistant who is poised to take the reins. In many cases, a line of assistants have endeavoured (but fallen short) of the task, ultimately departing, overwhelmed by the impenetrable nature of the hand-off.

Such sellers followed a maximalist approach to gathering inventory, going for volume of units over valuable items (although there are always treasures). If they were lucky, they bought the building. The truly canny will have locked in long term storage contracts to stockpile inventory. Every book town has at least one of these gems, through which collectors source material.

This article posits a future formed by the confluence of several transformations taking place in the rare book and paper market ecosystem.

The first has to do with the net addition of new collectors relying on the auction market. At first this was out of necessity during the Pandemic, however such converts have remained in the ecosystem due to the market-derived values they are able to monitor through publicly listed auction results. Supplemented by preliminary research to mitigate risk, these collectors are not likely to go back to traditional dealer-sourced channels. At least, they have their eye on both markets as outlined in my previous article for Rare Book Hub Monthly entitled “Where are we?”: https://rarebookhub.com/articles/3019

The second is the estimated influx of material entering the market in the coming decade from experienced collectors and seasoned booksellers. At present, there is a glut of exceptional material held in private collections, brick-and-mortar inventories, and among catalogue-centric booksellers. According to Statistica, by 2025, 20% of the United States population will be over the age of 65. Within the Book Trade, an estimated 30 to 40 percent of people are in this demographic. Without time and the development of a considered dissolution process, a great deal of knowledge, skill, and history is at risk of being lost along with their collections.

Below are six scenarios of current and likely business models and strategies employing Trade and Auction mentalities and the implications of such strategies for Dealers and their clients:

A. Born a Dealer, stay a Dealer

At present, many Booksellers maintain retail locations that predate the advent of online book sales. Some might own their building, but most are likely on a long-term lease. The shop owner intends to stay in the location, as there remains steady traffic in the area. This business even invested in online infrastructure, putting more valuable material online for sale through an ecommerce platform. They receive several calls a day from interested collectors looking to purchase and the family of deceased collectors offering to sell material, much of which the proprietor sold to the collector in the first place.

Assuming the business has maintained an eye for condition consistently in the acquisition of valuable material, remaining in a market where value is fixed and driven by fellow booksellers this business will see a decrease in sales and profit over time.

This sets the owner at a crossroads. Either the bookseller lists the item online or through catalogue awaiting a potential buyer, unable to target the market due to the day-to-day time demands of running a retail store. Alternatively, they can put the item up against others in an auction environment and have the Auction market it to prospective buyers.

Reluctance on the part of the bookseller to consider auction avenues results in cash flow issues, leaving the business forever reliant on selling high volumes of low-end material quickly.

Inventory turnover is key. Space is the currency in this scenario, leaving little room for valuable material because of the time required to carry out the sale. Because the bookseller will be dependent on Auctions to facilitate this segment of the strategy, net new clients will not be gained in this process, only a minor return on investment in order to cover the business’ overhead costs.

This business will survive for a few more years, if they are the best at something in their market, adept at marketing, and financially strong enough to transform when they need to.

B. Born a Dealer/Complement with auction

This Dealer is concerned with antiquarian and rare material in a rented location in a boutique part of town. They have specialists on staff and “wheelhouses” within which they are experts. They hold a deep inventory in ‘very good’ to ‘fine’ condition. Material is sourced through a variety of methods including outright purchasing as well as consignment, in some cases serving as a marketing agent for a collection of material.

Dealers such as this have a well-integrated online program listing their inventory on their own website, as well as several third-party platforms. They participate in international rare book fairs and occasionally sell through an auction house and typically have ‘a sense’ of the profile of the successful bidder.

This Dealer has true clients, rather than simple customer or transactional relationships. As a business, they likely have an intergenerational knowledge of the Trade, which makes it a great starting point for aspiring specialty Dealers.

However, this Dealer has a mounting dilemma: the Market demographic of their bread and butter subject offerings is either aging out or already has a sound collection. Across the board, the Dealer’s inventory is at a premium due to its exceptional nature (association copies, fine bindings, and so on). They are hearing word from mid-career collectors (a cohort considerably smaller than the 60+ demographic) that similar copies are available through auctions at a fraction of the price of the Dealer’s listings. Additionally, the very same collectors are learning what to look for at auction through the meticulously detailed catalogues the Dealer publishes.

This is a problem for the Dealer, since established clients are now questioning the way in which the Dealer is deriving value and, to wit, the value of their relationship with the Dealer themselves.

With a mix of owned inventory and consignment agreements, the Dealer’s offerings are stagnant and their collector base is diminishing. Something needs to change, fast.

Due to the high-value nature of the inventory, a Dealer of this stature cannot afford to continue relying on Auction houses to divest their material. Instead, they need to invest in hosting an auction platform of their own, similarly to how they rolled out their online storefront a decade earlier.

The value of this move is twofold. First, it demonstrates transparency to the Dealer’s established client base by offering market-derived prices. Second, the Dealer is able to retain valuable data about bidders. The auction platform is the key to building a sustainable client acquisition and retention strategy.

Such auctions could be a mix of owned inventory as well as consigned material. The proceeds could be used to acquire new collecting fields while phasing out of more traditional subjects. Additionally, Dealers pursuing this route are at an advantage to Auctions because of their secured supply of inventory and (potentially) reducing or eradicating premiums from their auctions.

This hybrid business approach is a transition strategy for a legacy Dealer intending to remain dominant in both private collector and institutional settings. It is also a potential exit strategy for a retiring Dealer, or a growth strategy for a younger Dealer. But it requires investment in new capabilities and capacities.

C. Born a Dealer/full transition to auction

This Dealer’s long-term lease is up in a couple of years. They have built a comprehensive clientele; however, sales have been steadily declining. They have witnessed material they sold going through auction as their collector clients are seeking higher returns as they dispense with their collections.

While their relationships with clients are strong and trust is high, the collectors are driven by the bottom line and are seeing conversion through publicly available auction results. The possibility of downsizing the shop is not an option, as rents have increased across the board (they would be paying more for less).

Something needs to be done with the inventory, and the business model.

This Dealer barely made the transition to online sales. Recently, they have made most of their major sales through in-person and virtual Fairs, as well as by selling to institutions. Although they cannot continue in a traditional retail business model, they also cannot step away from the Book business entirely. They have a significant role aiding their clients with deaccession and educating new collectors online by transitioning from the bookselling business into an auction platform — either by investing in the development of a custom auction platform or exclusive branded partnership with a third-party auction platform.

Admittedly this is an all-or-nothing strategy. It requires a total transformation of a Dealer’s marketing, positioning, and financial structure. However, it holds the potential to liquidate inventory while developing a service for those private collectors with whom the Dealer has fostered trusting relationships. It is also an opportunity to build a pipeline of new collectors. Well executed, this could be a value building, growth strategy.

D. Born auction

Established international auction houses have a limit to how low they can go on price when consigning material. This bar is being raised annually as the overheads of brick-and-mortar auction houses staffed by specialized personnel go up. Private collectors are left in the lurch in this dynamic, minding collections consisting primarily of middle value material. Their local bookseller who handles rare material cannot afford to take in the entire collection and the private collector is loath to have it split up, leaving them with only the lesser editions and tangential material to the main collecting focus.

The area of opportunity for this Collector is an online, specialized book auction platform.

At present, the primary model for this is Catawiki, where specialists inspect and vet material offered in online, timed sales. Because photography, storage, and shipping are arranged through the buyer and seller, this model allows for the auction house to keep their premiums at a minimum and process large volumes of low yield material that established auction houses cannot afford to handle. Assumed in this model is that the platform be designed by the company itself as well as running the marketing in-house. The low overhead frees up resources to market material and the relatively new profile of these businesses provide them a flexibility and ingenuity in where they target resulting in the potential of attracting net new collector clients. The position in the market for such platforms, combined with the low premiums, make this attractive to the aforementioned brick-and-mortar booksellers with inventory that was downgraded first by online retail, then further downgraded by the increasing incursion of auction houses into the market.

It is early days for this specialized model and will require significant start-up capital, as well as specialized expertise from both the Trade and Auction houses to legitimise the platform and streamline the process. However, given the trend toward auction participation as well as the influx of material into the marketplace in the coming decade, we will be seeing an increase of these platforms — perhaps followed by a consolidation (through acquisition, or otherwise).

E. Born auction/complement with brick and mortar

This is a speculative manifestation of the likely changes in the market for a brick-and-mortar location with a born digital auction platform.

Two things would be required in order for this to take place. First, a consolidation of the auction market so one organization has the lion’s share (or at least enough to feel confident in taking this risk). Their space would likely serve as a permanent showroom rather than an auction arena, offering an opportunity for the platform’s specialists to meet with sellers and buyers and/or facilitate educational programming to develop trust in the organization and attract the public into collecting.

The second requirement will be inventory. One of the defining characteristics of the ‘born auction’ category is that it does not handle the property offered; they merely facilitate the transaction. In a world where Dealers are managing the mounting influx of material combined with need to facilitate the buyer-side of transactions to keep the platform functioning, auction companies might begin purchasing inventory from Dealers, including catalogue descriptions to insure quality offerings. This would increase profit margins and (perhaps) enable auction companies to form partnerships with Dealers who have inventory and connections struggling to find new collectors.

It is unlikely that this hybrid will emerge immediately. However, given that online platforms are largely driven by venture capital, VC investors will be on the lookout for opportunities to increase profitability and growth (as well as market control) to increase the value of their company to prospective investors.

F. Do nothing

Doing nothing is an option for a brick-and-mortar Dealer with a majority of middle value inventory. At present, with an integrated online strategy as well as Fair attendance, they will be able to sustain themselves for a period of time.

Dealers have remarked that the increased standards of auction houses have had collectors come to them with material to sell. However, as born digital auction platforms are able to connect with prospective buyers and communicate the process clearly, replenishing inventory will become a challenge for such Dealers. This is detrimental to their overall business model. Dealers can’t sell a book they don’t have, and even if it was offered, they can’t afford to take on the risk.

Assuming the dealer’s inventory is comparable with items on offer through auction and dealer markets, a resolute stance will result in sellers avoiding them because offers are too low and buyers looking elsewhere because the high asking prices are not justified. There are four options to stall this descent:

• The dealer publicly states how value is derived

• Adopt an auction model to make values market driven

• Liquidate inventory

• Fundamentally transform the Dealer business model (see ‘Born a Dealer/Complement with auction’ or ‘Born a Dealer/full transition to auction’)

At the time of writing, we are coming into a week that will see the execution of 50-100 specialized auctions.

The opportunity to form collections is more available than ever and there is a new cohort of hybrid collectors who mine data as they surf online and do not see it as diluting the experience of collecting. Rather, they find using data to inform their acquisition reassuring. Engagement with the online world is a tool to enhance their experience in the physical one. It is a “yes/and” approach that employs a diverse range of channels, not an “either/or” of virtual over physical engagement.

Crucial to success of Dealers and Auctions in this emerging era of access and emergence of rare material from private collections is supply (CATALOGUE), developing a list of prospective buyers with an eye to emerging collecting practices (CLIENTS), and continual exposure to this audience — not only with upcoming offerings but also by demonstrating where and how value is derived (COMMUNICATION & COMPARISON).

At present, these four attributes are not obtained by either the dealer or auction segment of the market, however, the objective of securing all four will be the underlying forces that drive the emerging dynamic of the rare book and paper markets as online and auction entrenches itself and private collectors, equipped with the ability to independently analyze data, are weighing their options regarding the dispensation of their collections.

About Spencer W Stuart

Spencer W Stuart provides analytic services to collectors and dealers using auctions to build their collections and inventory. For Dealers, Spencer provides consulting services to develop hybrid or total transitions of book business to the use of auction mechanisms as a growth strategy.

In concert with his advising, Spencer is an active writer and lecturer on histories of the printed word for a variety of publications including The Book Collector and Amphora as well as with the Canadian Broadcasting Corporation.

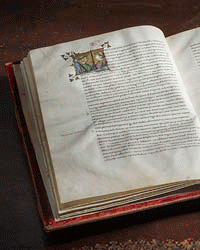

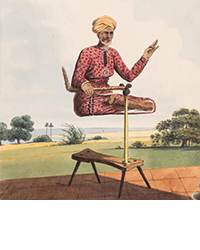

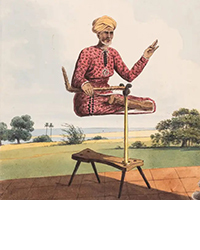

![Forum, Feb. 19: Lot 57[Album and Treatise on Hinduism], manuscript treatise on Hinduism in French, 31 watercolours of Hindu deities, Pondicherry, 1865. £3,000-4,000 Forum, Feb. 19: Lot 57[Album and Treatise on Hinduism], manuscript treatise on Hinduism in French, 31 watercolours of Hindu deities, Pondicherry, 1865. £3,000-4,000](https://ae-files.s3.amazonaws.com/AdvertisementPhotos/f70b3790-9b4a-4990-b402-f0322021c0de.jpg)

![Forum, Feb. 19: Lot 62 Allan (Capt. Alexander). Views in the Mysore Country,

[1794]. £2,000-3,000 Forum, Feb. 19: Lot 62 Allan (Capt. Alexander). Views in the Mysore Country,

[1794]. £2,000-3,000](https://ae-files.s3.amazonaws.com/AdvertisementPhotos/ad2cf7b4-4d93-4231-a956-b440583b39b3.jpg)

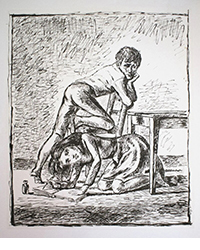

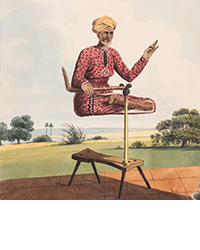

![Forum, Feb. 19: Lot 123D'Oyly (Charles). Behar Amateur Lithographic Scrap Book, lithographed throughout with title and 55 plates mounted on 43 paper leaves, [Patna], [1828]. £3,000-5,000 Forum, Feb. 19: Lot 123D'Oyly (Charles). Behar Amateur Lithographic Scrap Book, lithographed throughout with title and 55 plates mounted on 43 paper leaves, [Patna], [1828]. £3,000-5,000](https://ae-files.s3.amazonaws.com/AdvertisementPhotos/5651043b-3c0d-4e2c-931f-72133bda9b36.jpg)

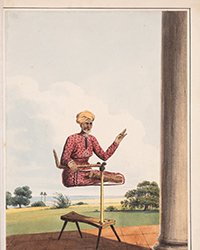

![Forum, Feb. 19: Lot 205Marshall (Sir John) and Alfred Foucher. The Monuments of Sanchi, 3 vol., first edition, 141 plates, most photogravure, [Calcutta], [1940]. £3,000-4,000 Forum, Feb. 19: Lot 205Marshall (Sir John) and Alfred Foucher. The Monuments of Sanchi, 3 vol., first edition, 141 plates, most photogravure, [Calcutta], [1940]. £3,000-4,000](https://ae-files.s3.amazonaws.com/AdvertisementPhotos/8c8244b7-4573-44d3-9c70-e0d3a3ed3cc4.jpg)

![Il Ponte, Feb. 25-26: HAMILTON, Sir William (1730-1803) - Campi Phlegraei. Napoli: [Pietro Fabris], 1776, 1779. € 30.000 - 50.000 Il Ponte, Feb. 25-26: HAMILTON, Sir William (1730-1803) - Campi Phlegraei. Napoli: [Pietro Fabris], 1776, 1779. € 30.000 - 50.000](https://ae-files.s3.amazonaws.com/AdvertisementPhotos/0372eeb9-97e1-47b2-baca-b3287d4704ee.jpg)

![Il Ponte, Feb. 25-26: [MORTIER] - BLAEU, Joannes (1596-1673) - Het Nieuw Stede Boek van Italie. Amsterdam: Pieter Mortier, 1704-1705. € 15.000 - 25.000 Il Ponte, Feb. 25-26: [MORTIER] - BLAEU, Joannes (1596-1673) - Het Nieuw Stede Boek van Italie. Amsterdam: Pieter Mortier, 1704-1705. € 15.000 - 25.000](https://ae-files.s3.amazonaws.com/AdvertisementPhotos/8f9ce440-b420-4407-8293-eb8e1b38ca19.jpg)

![Il Ponte, Feb. 25-26: TULLIO D'ALBISOLA (1899-1971) - Bruno MUNARI (1907-1998) - L'Anguria lirica (lungo poema passionale). Roma e Savona: Edizioni Futuriste di Poesia, senza data [ma 1933?]. € 20.000 - 30.000 Il Ponte, Feb. 25-26: TULLIO D'ALBISOLA (1899-1971) - Bruno MUNARI (1907-1998) - L'Anguria lirica (lungo poema passionale). Roma e Savona: Edizioni Futuriste di Poesia, senza data [ma 1933?]. € 20.000 - 30.000](https://ae-files.s3.amazonaws.com/AdvertisementPhotos/71bb9667-5d66-4aa8-96a2-9880c74a7a26.jpg)