By Bruce McKinney

The weekly auction reports, introduced a year ago, have been revised. Members who have signed up for the free weekly reports will see a revised report when they receive the next issue on Sunday evening. Casual observers can see the same reports in the Upcoming Auctions section of AE by selecting Recent Weekly Auction Reports. New reports are emailed Sunday evenings at 9:00 pm PST and posted in the Upcoming Auctions section at the same time. A link to sign-up is provided at the end of this article.

The revised report, for those who look into the details of specific auctions by selecting Click Here to View Top Ten Lots by Sale Price, will find four new fields highlighted in yellow in the auction summary that provide detailed information about overall performance. Buyers logically focus on specific lots but all items offered are also part of specific events and their overall performance varies widely from house to house, from event to event. Deconstructing results provides evidence of the current market as well as clues to how each auction approaches their business. These new fields provide more information about these differences.

Under the umbrella of 'auction' - variation between houses is the norm, but houses tend to be internally consistent even as they adjust to changing circumstances - so understanding how they did provides evidence about how they'll do. In many cases the past is proscriptive. About this you'll have your own opinion. In recognizing the changes that houses make you'll gain insight into how they view the market. Because auctions provide a steady drumbeat of sales there's a close to real time continuum of data that provides the best evidence available about the current state of the market. But you do have to sort it out yourself because the book business is a braided tapestry, 19th century fiction a world apart from 18th century science, 20th century poetry several time zones away from early travel and voyages.

In issuing weekly reports we have for the past year focused on success rates, that is the lots sold. The market is recovered sufficiently that we can more clearly identify the proportion of lots unsold and add an important statistic: total sales as a % of high estimate. This is a telling number.

Houses that accept or themselves impose reserves above current market value will tend to have a lower percentage of lots sold and also achieve a lower percentage of total receipts as measured by Total Sales as a % of High Estimate. If reserves are high fewer lots will sell and overall performance, as measured by total sales divided by the total high estimate, be lower. It may sound complicated but it reduces itself to a simple number.

A sale and the market will appear to be in balance when an auction achieves 100% of the high estimate. In a rising market that percentage will tend to be above 100%, in a declining market below. This said, these statistics can only be applied to auctions as a group. Specific sales will often be subject to random events that increase or decrease revenue. But taken together, these numbers provide a riveting picture of a selling channel constantly in flux, adjusting to changing demand.

Momentum, the rate of change and its implication for future pricing, is the subject of our ongoing study.

Sign up for free weekly reports.

Click to see the Upcoming Auction Page.

Click to see the most recent Weekly Auction Update.

Click to see an example to the new report.

formerly the

Americana Exchange

Americana Exchange

US / Canada Toll Free

(877)-323-RARE [7273]

(877)-323-RARE [7273]

Rare Book Monthly

-

Swann

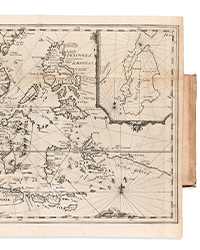

Maps & Atlases, Natural History & Color Plate Books

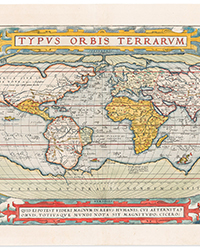

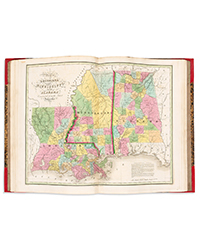

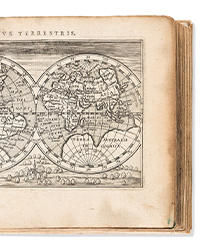

December 9, 2025Swann, Dec. 9: Lot 156: Cornelis de Jode, Americae pars Borealis, double-page engraved map of North America, Antwerp, 1593.Swann, Dec. 9: Lot 206: John and Alexander Walker, Map of the United States, London and Liverpool, 1827.Swann, Dec. 9: Lot 223: Abraham Ortelius, Typus Orbis Terrarum, hand-colored double-page engraved world map, Antwerp, 1575.Swann

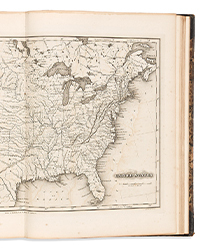

Maps & Atlases, Natural History & Color Plate Books

December 9, 2025Swann, Dec. 9: Lot 233: Aaron Arrowsmith, Chart of the World, oversize engraved map on 8 sheets, London, 1790 (circa 1800).Swann, Dec. 9: Lot 239: Fielding Lucas, A General Atlas, 81 engraved maps and diagrams, Baltimore, 1823.Swann, Dec. 9: Lot 240: Anthony Finley, A New American Atlas, 15 maps engraved by james hamilton young on 14 double-page sheets, Philadelphia, 1826.Swann

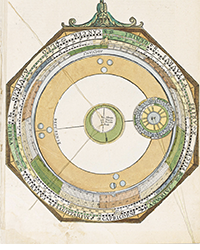

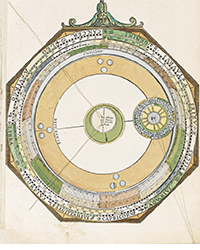

Maps & Atlases, Natural History & Color Plate Books

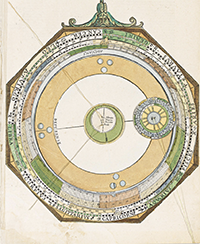

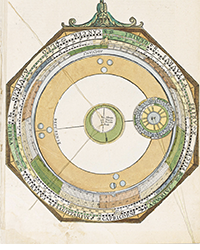

December 9, 2025Swann, Dec. 9: Lot 263: John Bachmann, Panorama of the Seat of War, portfolio of 4 double-page chromolithographed panoramic maps, New York, 1861.Swann, Dec. 9: Lot 265: Sebastian Münster, Cosmographei, Basel: Sebastian Henricpetri, 1558.Swann, Dec. 9: Lot 271: Abraham Ortelius, Epitome Theatri Orteliani, Antwerp: Johann Baptist Vrients, 1601.Swann

Maps & Atlases, Natural History & Color Plate Books

December 9, 2025Swann, Dec. 9: Lot 283: Joris van Spilbergen, Speculum Orientalis Occidentalisque Indiae, Leiden: Nicolaus van Geelkercken for Jodocus Hondius, 1619.Swann, Dec. 9: Lot 285: Levinus Hulsius, Achtzehender Theil der Newen Welt, 14 engraved folding maps, Frankfurt: Johann Frederick Weiss, 1623.Swann, Dec. 9: Lot 341: John James Audubon, Carolina Parrot, Plate 26, London, 1827. -

Sotheby’s

Book Week

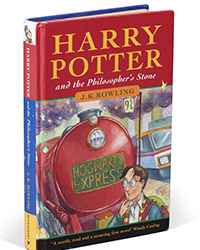

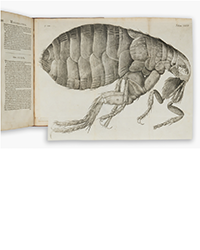

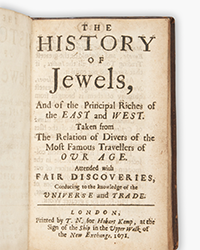

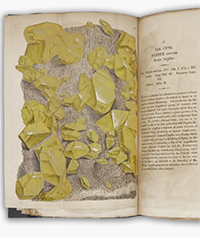

December 9-17, 2025Sotheby’s, Dec. 11: Darwin and Wallace. On the Tendency of Species to form Varieties..., [in:] Journal of the Proceedings of the Linnean Society, Vol. III, No. 9., 1858, Darwin announces the theory of natural selection. £100,000 to £150,000.Sotheby’s, Dec. 11: J.K. Rowling. Harry Potter and the Philosopher's Stone, 1997, first edition, hardback issue, inscribed by the author pre-publication. £100,000 to £150,000.Sotheby’s, Dec. 11: Wolfgang Amadeus Mozart. Autograph sketchleaf including a probable draft for the E flat Piano Quartet, K.493, 1786. £150,000 to £200,000.Sotheby’s, Dec. 12: Hooke, Robert. Micrographia: or some Physiological Descriptions of Minute Bodies made by Magnifying Glasses. London: James Allestry for the Royal Society, 1667. $12,000 to $15,000.Sotheby’s, Dec. 12: Chappuzeau, Samuel. The history of jewels, first edition in English. London: T.N. for Hobart Kemp, 1671. $12,000 to $18,000.Sotheby’s, Dec. 12: Sowerby, James. Exotic Mineralogy, containing his most realistic mineral depictions, London: Benjamin Meredith, 1811, Arding and Merrett, 1817. $5,000 to $7,000. -

Rare Book Hub is now mobile-friendly!

![<b>Sotheby’s, Dec. 11:</b> Darwin and Wallace. On the Tendency of Species to form Varieties..., [in:] <i>Journal of the Proceedings of the Linnean Society,</i> Vol. III, No. 9., 1858, Darwin announces the theory of natural selection. £100,000 to £150,000. <b>Sotheby’s, Dec. 11:</b> Darwin and Wallace. On the Tendency of Species to form Varieties..., [in:] <i>Journal of the Proceedings of the Linnean Society,</i> Vol. III, No. 9., 1858, Darwin announces the theory of natural selection. £100,000 to £150,000.](https://ae-files.s3.amazonaws.com/AdvertisementPhotos/00d5fd41-2542-4a80-b119-4886d4b9925f.png)