The hallmark of the rare books and paper field has long been obscurity. Publicly, few seem to know, but the reality is that both the highly skilled and highly intelligent often do. That’s why a few people make a lot of money buying and selling, while others get buried in their books. The idea, the very possibility, that value can be routinely calculated, seems to undermine the field’s basic premise that only the great Svengalis with their Ouija boards can navigate the Byzantine empire of collectible paper. The Rare Book Batch Valuation Service has been created to put inflation-adjusted values (median and weighted average) and frequency of appearance (at auction) at the fingertips of those who prefer to know rather than guess.

Worse yet, it makes it easy to see how your investments in your collection or inventory, look compared to changing prices quarter by quarter. Good grief!

Reality is like the proverbial ghost that, though you keep your eyes closed, will appear when financial need demands or family members decide to convert your material into cash. Alas, alas.

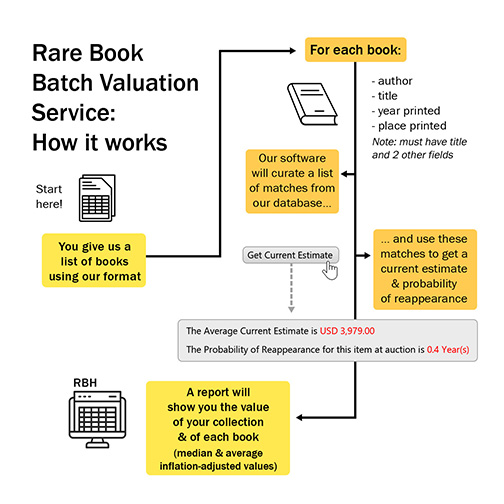

How do we do this?

We have built a database of auction sales covering the past 170 years that provide prices and perspective on frequency or infrequency of appearance in the auction rooms. To do this we document more than 12,450,000 appearances while continuing to add both old and new sales to the database we call the Rare Book Transaction History database. In a typical quarter, we add 250,000 lots.

Five populations use our services and we expect they’ll use them somewhat differently.

Institutions. For institutions there is the proverbial triple play. Understanding financial value is a vital aspect for replacement and insurance. For acquisitions, understanding valuation help both donors and institutions to be on the same page. When deciding about deaccessions, using this service is step No. 1.

Auction Houses. Auction houses receive hundreds of inquiries from prospective consignors every day. Batch valuation turns those inquiries into immediate answers, making it possible to shorten the time from 1st inquiry to the bang of the gavel. Net, net, more consignments and more sales. Speed matters!

Collectors. Batch valuation is the single biggest enhancement for collectors in decades. Build your collection and follow its progress as its components appear in the auction rooms. Are your prices paid looking good or are you getting buried in your books? In all likelihood, some material will be great wins and others not so much. Whether you’re winning or not, you’ll understand how the market place judges your acquisitions.

Appraisers. Batch valuation will keep appraisers busy. This interactive tool will permit skilled professionals to see collections in their totality and be able to interpret what the facts show. Many institutions will employ appraisers for 3rd party confirmation.

Dealers. Dealers will need this software even if they deny it. Within two years the majority of buyers will demand it because the folks that will write the big checks will want to see confirmation that offers they receive are logical. As well, dealers over 65, are going to find BV to be a straightforward way to adjust prices to keep inventory priced near current valuation as they begin to thin their holdings in preparation for retirement.

For many, this service will be useful.

All in all, typical tests of this new service appear to have about 500 items, although there are no statutory minimums or maximums. For everyone, this is a new process and we don’t expect everyone is going to like the idea. Those who have long been called Svengali aren’t going to be pleased to see their horses turned into the horsepower you’ll use Batch Valuation to navigate this complex field.

If you are interested in trying out the Rare Book Batch Valuation Service, more detailed information follows.

How are results presented?

The Batch Valuation Service generates an Excel spreadsheet containing several sheets. In the Valuation Summary sheet, we provide an overview of each individual item evaluated, including the number of relevant records found, median inflation-adjusted value, a weighted average inflation-adjusted value, and probability of reappearance at auction (measured in years). In the Underlying Records sheet, every record we find is included with the same data found via single searches of the Transaction History Database. These are sortable and filterable using Excel’s core functionality. Every underlying record with a price is converted to US dollars based on the exchange rate at the time of sale and adjusted for inflation using our Rare Book Price Index (generated each year based on the median realized price at auction compared to the previous year).

Free Trial for Annual Subscribers

Since Batch Valuation is still in Beta formation, we are making free test runs available to paid annual subscribers to the Rare Book Transaction History at no cost. Up to 3 runs of up to 500 titles may be submitted without charge now through December 31, 2022. Naturally, we welcome your feedback as we work to perfect the presentation of results and the algorithms that power the estimates to best serve your needs. We are available for follow up Zoom sessions to discuss results and receive your feedback and ideas for ways to improve the service!

How to Submit Your Files

We use a specific Excel format for uploading lists of material. The image below shows the template format with a few example books. The only required fields (where available) are Author, Title, Year Printed, and Place Printed. Three of these four fields (with title being mandatory) are required for an item to be valued. InternalCatalogID is for your personal use and reference. All other fields can be populated, but they will not be used for batch valuation purposes.

When your Excel file is ready, please send an email to bv@rarebookhub.com with your file attached and the following information:

Client Name

Individual, Company or Institution name

Phone number (optional)

Your RBH username (account log-in name)

Email associated with your account (if different from the one being used to send the email)

![<b>Scandinavian Art & Rare Books Auctions, Dec. 4:</b> ROALD AMUNDSEN: «Sydpolen» [ The South Pole] 1912. First edition in jackets and publisher's slip case. <b>Scandinavian Art & Rare Books Auctions, Dec. 4:</b> ROALD AMUNDSEN: «Sydpolen» [ The South Pole] 1912. First edition in jackets and publisher's slip case.](https://ae-files.s3.amazonaws.com/AdvertisementPhotos/0a99416d-9c0f-4fa3-afdd-7532ca8a2b2c.jpg)

![<b>Scandinavian Art & Rare Books Auctions, Dec. 4:</b> AMUNDSEN & NANSEN: «Fram over Polhavet» [Farthest North] 1897. AMUNDSEN's COPY! <b>Scandinavian Art & Rare Books Auctions, Dec. 4:</b> AMUNDSEN & NANSEN: «Fram over Polhavet» [Farthest North] 1897. AMUNDSEN's COPY!](https://ae-files.s3.amazonaws.com/AdvertisementPhotos/a077b4a5-0477-4c47-9847-0158cf045843.jpg)

![<b>Scandinavian Art & Rare Books Auctions, Dec. 4:</b> ERNEST SHACKLETON [ed.]: «Aurora Australis» 1908. First edition. The NORWAY COPY. <b>Scandinavian Art & Rare Books Auctions, Dec. 4:</b> ERNEST SHACKLETON [ed.]: «Aurora Australis» 1908. First edition. The NORWAY COPY.](https://ae-files.s3.amazonaws.com/AdvertisementPhotos/6363a735-e622-4d0a-852e-07cef58eccbe.jpg)

![<b>Scandinavian Art & Rare Books Auctions, Dec. 4:</b> SHACKLETON, BERNACCHI, CHERRY-GARRARD [ed.]: «The South Polar Times» I-III, 1902-1911. <b>Scandinavian Art & Rare Books Auctions, Dec. 4:</b> SHACKLETON, BERNACCHI, CHERRY-GARRARD [ed.]: «The South Polar Times» I-III, 1902-1911.](https://ae-files.s3.amazonaws.com/AdvertisementPhotos/3ee16d5b-a2ec-4c03-aeb6-aa3fcfec3a5e.jpg)

![<b>Scandinavian Art & Rare Books Auctions, Dec. 4:</b> [WILLEM BARENTSZ & HENRY HUDSON] - SAEGHMAN: «Verhael van de vier eerste schip-vaerden […]», 1663. <b>Scandinavian Art & Rare Books Auctions, Dec. 4:</b> [WILLEM BARENTSZ & HENRY HUDSON] - SAEGHMAN: «Verhael van de vier eerste schip-vaerden […]», 1663.](https://ae-files.s3.amazonaws.com/AdvertisementPhotos/d5f50485-7faa-423f-af0c-803b964dd2ba.jpg)

![<b>Scandinavian Art & Rare Books Auctions, Dec. 4:</b> TERRA NOVA EXPEDITION | LIEUTENANT HENRY ROBERTSON BOWERS: «At the South Pole.», Gelatin Silver Print. [10¾ x 15in. (27.2 x 38.1cm.) ]. <b>Scandinavian Art & Rare Books Auctions, Dec. 4:</b> TERRA NOVA EXPEDITION | LIEUTENANT HENRY ROBERTSON BOWERS: «At the South Pole.», Gelatin Silver Print. [10¾ x 15in. (27.2 x 38.1cm.) ].](https://ae-files.s3.amazonaws.com/AdvertisementPhotos/fb024365-7d7a-4510-9859-9d26b5c266cf.jpg)

![<b>Scandinavian Art & Rare Books Auctions, Dec. 4:</b> PAUL GAIMARD: «Voyage de la Commision scientific du Nord, en Scandinavie, […]», c. 1842-46. ONLY HAND COLOURED COPY KNOWN WITH TWO ORIGINAL PAINTINGS BY BIARD. <b>Scandinavian Art & Rare Books Auctions, Dec. 4:</b> PAUL GAIMARD: «Voyage de la Commision scientific du Nord, en Scandinavie, […]», c. 1842-46. ONLY HAND COLOURED COPY KNOWN WITH TWO ORIGINAL PAINTINGS BY BIARD.](https://ae-files.s3.amazonaws.com/AdvertisementPhotos/a7c0eda0-9d8b-43ac-a504-58923308d5a4.jpg)

![<b>Sotheby’s, Dec. 11:</b> Darwin and Wallace. On the Tendency of Species to form Varieties..., [in:] <i>Journal of the Proceedings of the Linnean Society,</i> Vol. III, No. 9., 1858, Darwin announces the theory of natural selection. £100,000 to £150,000. <b>Sotheby’s, Dec. 11:</b> Darwin and Wallace. On the Tendency of Species to form Varieties..., [in:] <i>Journal of the Proceedings of the Linnean Society,</i> Vol. III, No. 9., 1858, Darwin announces the theory of natural selection. £100,000 to £150,000.](https://ae-files.s3.amazonaws.com/AdvertisementPhotos/00d5fd41-2542-4a80-b119-4886d4b9925f.png)