The year 2020 was a year like no other. The coronavirus pandemic was bad for way more businesses than it was good. Many went under. What would this mean for books and other paper collectibles? Would unemployment rates that soared higher than at any time since the Great Depression severely damage the trade, or would people stuck at home but not financially hurt exchange dollars usually spent on entertainment for building their collections? The experiences felt by many dealers was different, but for auctions of books and other paper collectibles, the answer was collectors repurposed those dollars rather than hording them. They collected. It was an exceptionally good year at auction.

The median or midpoint price of all lots sold was $285. In 2019, it was $275. That was an increase of 3.6%, more than erasing a 2.8% drop the year before. It was the highest since 2014 when it was $286. The average price declined from $1,834 to $1,684, but the average is highly affected by a few sales at the very top, rather than reflecting the overall market. As noted last month in our report on the Top 500 paid at auction, prices were soft at the very high end.

One might think the increase in prices was balanced by fewer sales being made but that was not the case. The sell-through rate was an astonishing 83%. That was up from 77% the previous year. In fact, that was the highest sell-through rate since we have been tracking these numbers in 2004 and it wasn't even close. This was the first time it has exceeded 80%. And, that was not because fewer items were offered. That number was also up, slightly, to 521,422, or 4,000 more than the prior year. The number of lots sold in 2020 was 430,544 vs. 395,690 in 2019. Interestingly, the total dollar volume of sales was exactly the same as 2019 - $725 million. What that represented was a decline in prices at the high end balanced by an increase in prices and sales of material at the lower and middle ranges. That is a change in what we have come to expect – strength at the top with weakening demand at the lower and middle prices. That was a surprising revelation.

We recognize that many dealers have not experienced such a good year as their model was not as amenable to a lock-down year. Auction sales have been evolving more and more toward an online, virtual model for years. Most sales are no longer made to buyers present in the auction rooms. Rather, they go to online and telephone bidders. On the other hand, many dealers have relied on in-person contact, either in their bookstores or through participation at live book fairs. Many found their stores forced to close during the pandemic, and even when allowed to be open, few people dared to venture out to public spaces, particularly among the more vulnerable older people who make up a large part of the collecting market. Meanwhile, live fairs came to a screeching halt after the New York fairs in early March and never resumed.

The reality is many dealers have been struggling for many years as the older models for book selling have not worked as well in the current market. Herein lies a potential long term bright spot for the dealers in the midst of this difficult year. One has been the emergence of paper collectibles other than books, such as manuscripts, photographs, prints, comic books, even baseball cards. Even among book buyers, more collectors are collecting a subject, rather than a type, that is, buying books, manuscripts, prints etc. pertaining to a favored subject, rather than buying only books or prints, etc. Many dealers are expanding their inventory to meet this changing demand, rather than limiting themselves to a single shrinking part of the market.

The other bright spot is the surprising success of the virtual book fairs. Reports from both dealers and fair organizers have mostly been very positive, and it appears that this new sales vehicle will remain even after the coronavirus is gone. There is something new under the sun in book and paper selling after all, and this one has some major advantages over the live book fair. It is easier to prepare for this type of fair and the cost of participation is much less for the dealer. Selling more is only one way of improving profitability. Reducing costs is the other.

Here are some more statistics from auction sales for 2020. As usual, more lots sold for over the auction houses' high estimate than below it, 59%-22%. However, that is a misleading number since lots that do not sell are really the same as selling for less than the low estimate. In 2019, 42.2% of all lots sold for over the highest estimate, while slightly more, 43.4%, either sold below the low estimate or did not sell at all. In 2020 there was a complete reversal. 48.6% of all lots offered sold above their high estimates while 35.5% sold under the low estimate or not at all. Apparently, even the auction houses did not anticipate such robust prices.

The busiest quarter was, as usual, the fourth, with 32.2% of the lots offered in the last quarter. That was up from 31% the prior year. In 2019, May was the busiest month, but for whatever reason, it was only the fifth most active month in 2020. Most likely, the auction houses were still adjusting to the pandemic. Most years, November is the busiest, but for the first time, the highest number of lots were offered in December, saving the most, if not the best, for last. 11.5% of all lots were offered in December compared to 5.3% in August, the slowest month. Nevertheless, August has been the fastest growing month in recent years as more houses try to reach buyers at a time of year when competition is not as great.

The highest average price went to the Arader Galleries in-house auctions at $28,912 per lot. Next came Christie's King Street London at $23,418, followed by Christie's New York and Sotheby's New York, both at $21,000-plus. These numbers were mostly down, reflective of some softness at the top. At the other end of the scale, there are still bargains available in the Lancaster Mennonite Historical Society sales with an average of $53 per lot, and Alaska Auction at $66. Those who collect on a limited budget will be pleased that 16 houses had median prices under $100.

As for who sold (and offered) the most lots it again was not close. That went to Heritage Auction, which sold 179,915 lots. Only two others were over 10,000, Catawiki with 15,618 and RR Auction with 10,730. Trilium, Forum, Holabird Kagin, and PBA all had over 9,000.

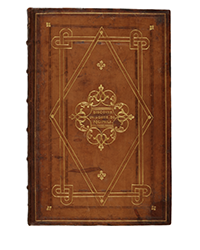

![<b>Heritage, Dec. 15:</b> John Donne. <i>Poems, By J. D. With Elegies on the Author's Death.</i> London: M[iles]. F[lesher]. for John Marriot, 1633. <b>Heritage, Dec. 15:</b> John Donne. <i>Poems, By J. D. With Elegies on the Author's Death.</i> London: M[iles]. F[lesher]. for John Marriot, 1633.](https://ae-files.s3.amazonaws.com/AdvertisementPhotos/8caddaea-4c1f-47a7-9455-62f53af36e3f.jpg)

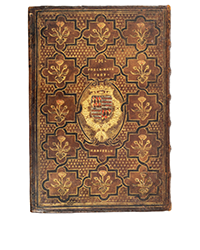

![<b>Sotheby’s, Dec. 16:</b> [Austen, Jane]. A handsome first edition of <i>Sense and Sensibility,</i> the author's first novel. $60,000 to $80,000. <b>Sotheby’s, Dec. 16:</b> [Austen, Jane]. A handsome first edition of <i>Sense and Sensibility,</i> the author's first novel. $60,000 to $80,000.](https://ae-files.s3.amazonaws.com/AdvertisementPhotos/9a74d9ff-42dd-46a1-8bb2-b636c4cec796.png)