The year 2019 saw a modest decline in the prices of books and paper at auction, although the number of lots offered and percentage of lots sold both increased significantly. The why for the decrease in price is uncertain. Macro economic factors can play a significant role, but the economy in the western world was good, the stock market unusually strong. On the other hand, there is much uncertainty out there, impeachment in America, Brexit in Europe. Perhaps it was a good year to keep your money in the stock market, rather than buying physical assets.

The median price of all lots sold in 2019 was $275. That was down from $283 in 2018, a drop of 2.8%. The average price was down more, 5.7% from $1,945 in 2018 to $1,834 in 2019. However, average price is a less accurate gauge of the market than is the median as it can be substantially impacted by a small number of very expensive lots.

On the other hand, both the number of lots offered and the sell-through rate saw significant increases. There were 517,145 lots offered in 2019, an increase of 8%. Despite the added volume, the sell-through rate increased from 74.9% in 2018 to 76.5% in 2019.

What is the reason for this apparent anomaly of sales rates increasing but prices declining? One possible explanation is the increased number of lots coming into the market is driving down prices by competing for the same collector dollars. That is the basic economic supply and demand model, increased supply resulting in lower prices. Another possible explanation is that the higher sell-through rates reflect auction houses setting lower minimum acceptable prices, or in some cases, none at all. Certainly, the high conversion rates at some houses, occasionally approaching 100%, is a sign that minimum bids are sometimes being set very low. This is particularly true with lower priced items, as auction houses and consignors simply want to move this type of material. They do not want it back as auctions are often the last option available for selling books of lower value.

It is generally understood in the trade that middle to lower value books and ephemera are challenged in the marketplace, while the top end remains strong. However, that does not appear to explain the slightly under 3% drop in prices this past year. Looking at the price of the 500th most expensive lot at auction for the year gives us a window on how firm prices are at the top of the market. In 2018, the 500th most expensive item sold for $87,500. In 2019, the 500th highest price was only $81,250. That represents a 7% decline at the top of the market.

Along with the supply-demand issue, there is one other factor to take into account – 2018 was a very strong year for prices. The median price in 2019 shot up from $267 the previous year to $283, an increase of 6%. Perhaps the market was just a bit overextended in 2018. What happened in 2019 is the market gave back half of the previous year's gain. Over the past two years, prices are still up 3%.

Despite the lower prices, the total spent at auction for books and paper increased in 2019. We recorded $725 million in sales, versus $698 million the previous year. That represents an increase of 4% in dollars spent at auction in the field for 2019.

As is usually, the case, twice as many lots sold for over the high estimate as below the low estimate, 55%-26%. However, if you add lots that did not sell at all to those that sold below the low estimate, it reveals an almost even split, 43.4% below or unsold, 42.2% above. The remainder either sold within the estimate range, or the house provided no estimate.

In a repeat of the previous year's numbers, 22% of the lots sold for over $1,000, 6% for over $5,000, 3% for more than $10,000. At the other end, 23% of the lots sold for $100 or less.

Once again, the fourth quarter of the year was the busiest time for sales, a bit more so this past year. 31% of lots were offered in the fourth quarter vs. 28% in the runner-up, the second quarter. As always, the third quarter was the slowest time, with only 19.1% of lots offered. However, May was the most active month, with 11.6% of all lots offered in that month. The slowest, as always, was August, in the middle of summer vacations. Only 4.6% of all lots were placed for sale in August.

The highest average lot price went to Sotheby's in New York at $35,776. Runner-up was Christie's London-King Street at $28,347. Three each of the top seven average prices went to branches of Sotheby's and Christie's, the other being the Arader Galleries with an average of $16,578. They sell many plates from the first edition of Audubon's The Birds of America, which draw high prices. Other auction houses averaging over $5,000 per lot were Pierre Bergé & Associates, Ketterer Kunst Doerling, Profiles in History, Artcurial, Aguttes, and three branches of Bonhams.

At the other end of the scale was the Lancaster Mennonite Historical Association sales that always provide prices suitable for beginning collectors. Their average sale price was $42, which was actually a substantial increase from the previous year's average of $25. Other auction houses with average sale prices under $100 were Alaska Auction, Thomson Roddick, Over & Above, National Book, and Garth's. Sixteen houses had a median sale price under $100, the lowest being Lancaster Mennonite and Alaska Auctions at $17. There are plenty of opportunities for collectors at all different price levels.

In terms of lots sold, the runaway leader was Heritage Auctions with around 170,000. Only two other houses exceeded 10,000 lots, both just barely, RR Auction and Holabird Kagin Americana. Even adding all locations, no others sold 10,000 lots in the books and paper field in 2019.

![<b>Scandinavian Art & Rare Books Auctions, Dec. 4:</b> ROALD AMUNDSEN: «Sydpolen» [ The South Pole] 1912. First edition in jackets and publisher's slip case. <b>Scandinavian Art & Rare Books Auctions, Dec. 4:</b> ROALD AMUNDSEN: «Sydpolen» [ The South Pole] 1912. First edition in jackets and publisher's slip case.](https://ae-files.s3.amazonaws.com/AdvertisementPhotos/0a99416d-9c0f-4fa3-afdd-7532ca8a2b2c.jpg)

![<b>Scandinavian Art & Rare Books Auctions, Dec. 4:</b> AMUNDSEN & NANSEN: «Fram over Polhavet» [Farthest North] 1897. AMUNDSEN's COPY! <b>Scandinavian Art & Rare Books Auctions, Dec. 4:</b> AMUNDSEN & NANSEN: «Fram over Polhavet» [Farthest North] 1897. AMUNDSEN's COPY!](https://ae-files.s3.amazonaws.com/AdvertisementPhotos/a077b4a5-0477-4c47-9847-0158cf045843.jpg)

![<b>Scandinavian Art & Rare Books Auctions, Dec. 4:</b> ERNEST SHACKLETON [ed.]: «Aurora Australis» 1908. First edition. The NORWAY COPY. <b>Scandinavian Art & Rare Books Auctions, Dec. 4:</b> ERNEST SHACKLETON [ed.]: «Aurora Australis» 1908. First edition. The NORWAY COPY.](https://ae-files.s3.amazonaws.com/AdvertisementPhotos/6363a735-e622-4d0a-852e-07cef58eccbe.jpg)

![<b>Scandinavian Art & Rare Books Auctions, Dec. 4:</b> SHACKLETON, BERNACCHI, CHERRY-GARRARD [ed.]: «The South Polar Times» I-III, 1902-1911. <b>Scandinavian Art & Rare Books Auctions, Dec. 4:</b> SHACKLETON, BERNACCHI, CHERRY-GARRARD [ed.]: «The South Polar Times» I-III, 1902-1911.](https://ae-files.s3.amazonaws.com/AdvertisementPhotos/3ee16d5b-a2ec-4c03-aeb6-aa3fcfec3a5e.jpg)

![<b>Scandinavian Art & Rare Books Auctions, Dec. 4:</b> [WILLEM BARENTSZ & HENRY HUDSON] - SAEGHMAN: «Verhael van de vier eerste schip-vaerden […]», 1663. <b>Scandinavian Art & Rare Books Auctions, Dec. 4:</b> [WILLEM BARENTSZ & HENRY HUDSON] - SAEGHMAN: «Verhael van de vier eerste schip-vaerden […]», 1663.](https://ae-files.s3.amazonaws.com/AdvertisementPhotos/d5f50485-7faa-423f-af0c-803b964dd2ba.jpg)

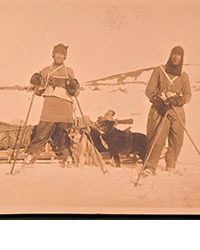

![<b>Scandinavian Art & Rare Books Auctions, Dec. 4:</b> TERRA NOVA EXPEDITION | LIEUTENANT HENRY ROBERTSON BOWERS: «At the South Pole.», Gelatin Silver Print. [10¾ x 15in. (27.2 x 38.1cm.) ]. <b>Scandinavian Art & Rare Books Auctions, Dec. 4:</b> TERRA NOVA EXPEDITION | LIEUTENANT HENRY ROBERTSON BOWERS: «At the South Pole.», Gelatin Silver Print. [10¾ x 15in. (27.2 x 38.1cm.) ].](https://ae-files.s3.amazonaws.com/AdvertisementPhotos/fb024365-7d7a-4510-9859-9d26b5c266cf.jpg)

![<b>Scandinavian Art & Rare Books Auctions, Dec. 4:</b> PAUL GAIMARD: «Voyage de la Commision scientific du Nord, en Scandinavie, […]», c. 1842-46. ONLY HAND COLOURED COPY KNOWN WITH TWO ORIGINAL PAINTINGS BY BIARD. <b>Scandinavian Art & Rare Books Auctions, Dec. 4:</b> PAUL GAIMARD: «Voyage de la Commision scientific du Nord, en Scandinavie, […]», c. 1842-46. ONLY HAND COLOURED COPY KNOWN WITH TWO ORIGINAL PAINTINGS BY BIARD.](https://ae-files.s3.amazonaws.com/AdvertisementPhotos/a7c0eda0-9d8b-43ac-a504-58923308d5a4.jpg)

![<b>Sotheby’s, Dec. 11:</b> Darwin and Wallace. On the Tendency of Species to form Varieties..., [in:] <i>Journal of the Proceedings of the Linnean Society,</i> Vol. III, No. 9., 1858, Darwin announces the theory of natural selection. £100,000 to £150,000. <b>Sotheby’s, Dec. 11:</b> Darwin and Wallace. On the Tendency of Species to form Varieties..., [in:] <i>Journal of the Proceedings of the Linnean Society,</i> Vol. III, No. 9., 1858, Darwin announces the theory of natural selection. £100,000 to £150,000.](https://ae-files.s3.amazonaws.com/AdvertisementPhotos/00d5fd41-2542-4a80-b119-4886d4b9925f.png)