Sotheby's has been selling property for others going on three centuries now. Two weeks ago, the tables were turned. This time, it was Sotheby's itself that was sold. The hammer price was $3.7 billion, undoubtedly the highest realization ever at Sotheby's, although the sale did not take place in the auction rooms. It was a private sale.

The buyer officially was BidFair USA, but that is an entity wholly owned by entrepreneur Patrick Drahi and his family. Mr. Drahi is a French and Israeli citizen who has had enormous success in the telecommunications and digital media sphere. He owns several such companies in Europe along with major shares in a couple of cable companies in the U.S. Mr. Drahi's wealth is primarily based on being a 60% shareholder in the European firm Altice. Fortune Magazine estimates his financial worth as being $9.3 billion.

Mr. Drahi is also a noted art collector and has long been a client of Sotheby's.

In announcing the sale, Sotheby's CEO Tad Smith said, "Patrick Drahi is one of the most well-regarded entrepreneurs in the world, and on behalf of everyone at Sotheby’s, I want to welcome him to the family. Known for his commitment to innovation and ingenuity, Patrick founded and leads some of the most successful telecommunications, media and digital companies in the world. He has a long-term view and shares our brand vision for great client service and employing innovation to enhance the value of the company for clients and employees. This acquisition will provide Sotheby’s with the opportunity to accelerate the successful program of growth initiatives of the past several years in a more flexible private environment. It positions us very well for our future and I strongly believe that the company will be in excellent hands for decades to come with Patrick as our owner."

Domenico De Sole, Chairman of the Board of Sotheby's, added, “Following a comprehensive review, the Board enthusiastically supports Mr. Drahi’s offer, which delivers a significant premium to market for our shareholders. After more than 30 years as a public company, the time is right for Sotheby’s to return to private ownership to continue on a path of growth and success."

For his part, Mr. Drahi commented, "I am honored that the Board of Sotheby’s has decided to recommend my offer. Sotheby’s is one of the most elegant and aspirational brands in the world. As a longtime client and lifetime admirer of the company, I am acquiring Sotheby’s together with my family. We thank Domenico and the rest of the Sotheby’s Board for its support and look forward to getting started with Tad and the wonderful members of his team to define our future."

Perhaps Mr. Drahi will be able to reprise the old Victor Kiam commercial, when after purchasing the Remington shaver company, he announced, "I liked the shaver so much, I bought the company."

Sotheby's was founded in 1744 when it presided over the sale of a collection of books. It is named for one of its founders, John Sotheby. For two centuries, the company was located exclusively in London, but the firm opened its first overseas office, in New York, in the 1950s. After an even longer period as a private company, Sotheby's went public in the late 1970s, returning to private status a few years later. In 1988, Sotheby's again went public and has been a publicly held company, traded on the New York Stock Exchange, ever since.

As to how Mr. Drahi was able to obtain board and shareholder approval of his proposal so quickly, one need only look at his offer. It was a generous 61% higher than the closing stock price the day prior. It last traded for $35.39 per share on June 14, before the announcement. The $3.7 million offered amounts to $57 per share. Not bad for a day's investment. Interestingly, while stocks often rise shortly before such a deal is announced, a sign that somebody knows what is about to happen, Sotheby's stock traded in the $35s all the previous week, evidence that Sotheby's and Mr. Drahi succeeded in keep their plans tightly under wraps.

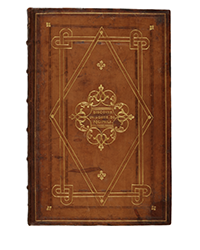

![<b>Heritage, Dec. 15:</b> John Donne. <i>Poems, By J. D. With Elegies on the Author's Death.</i> London: M[iles]. F[lesher]. for John Marriot, 1633. <b>Heritage, Dec. 15:</b> John Donne. <i>Poems, By J. D. With Elegies on the Author's Death.</i> London: M[iles]. F[lesher]. for John Marriot, 1633.](https://ae-files.s3.amazonaws.com/AdvertisementPhotos/8caddaea-4c1f-47a7-9455-62f53af36e3f.jpg)

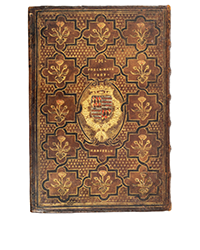

![<b>Sotheby’s, Dec. 16:</b> [Austen, Jane]. A handsome first edition of <i>Sense and Sensibility,</i> the author's first novel. $60,000 to $80,000. <b>Sotheby’s, Dec. 16:</b> [Austen, Jane]. A handsome first edition of <i>Sense and Sensibility,</i> the author's first novel. $60,000 to $80,000.](https://ae-files.s3.amazonaws.com/AdvertisementPhotos/9a74d9ff-42dd-46a1-8bb2-b636c4cec796.png)