Prices rose sharply at auction in 2018 for collectible books and paper. The median price was up 6% over 2017, reversing a trend of flat to down since 2014. Prices in 2018 were the fifth highest on record. Another 2% increase will be sufficient to take prices above three of those higher years - 2014, 2006, and 2005. However, it will take another 16% to bring them above the skyrocketing prices of 2007, the year before the recession of 2008. Ten years later and there is still ground to make up. That is a reflection of just how serious the recession was. The only longer gap came after the Great Depression. It took prices 20 years to recover to their previous high point in 1927.

We do not know how prices fared in private sales as those results are not publicly available. However, these auction numbers should provide some optimism for other booksellers, though some types of books and paper fare better than others. The most collectible material, another way of saying the most expensive material, continues to lead the way. Last month's review of the Top 500 most expensive items at auction revealed that the 500th most expensive item was 22% higher than the previous year, an indication of even greater increases at the top end of the market (click here to see the Top 500 of 2018).

Average price was also up, by 4.6% from $1,859 to $1,945. However, this figure is not as accurate a reflection of the overall market as median price, since average price can be distorted by a small number of very expensive items.

The number of lots offered and sold at auction also increased substantially in 2018. While increasing reliance on auctions has to some degree reflected a softness in the market the past few years, that was evidently not much of a problem in 2018. For last year, 479,122 lots were offered, while 358,924 were sold. The sell-through rate was 74.9%, up slightly from 74.7% the previous year. Those are strong sell-through numbers, as for most of the post-recession years, the sales percentage ranged from the upper 60s to low 70s. Sell-through percentage was able to inch up despite a 14.6% increase in the number of lots offered. Number of lots sold increased by 15%.

Looking at dollar volume of sales, 2018's numbers are even more impressive. They totaled $698,000,000 in 2018, up from $580,000,000 in 2017. That is an increase of 20.3% in dollars spent. The added volume of lots offered in no way discouraged collectors willingness to bid up the prices.

The price increases were also reflected in the price ranges. For 2018, 22% of lots sold for under $100 vs. 24% in 2017, 78% below $1,000 vs. 79% in 2017. At the other end, 22% sold for over $1,000 vs. 21% in 2017, while once again 6% were above $5,000, 3% above $10,000.

Despite the higher prices, the auction houses still tended to overestimate somewhat in terms of anticipated prices. While 54% achieved prices above the high estimate vs. 27% below the low estimate, that figure is misleading. It's necessary to add those lots that did not sell at all to those that sold below the low estimate to get an accurate picture. This shows that 45% of the lots sold below the low estimate vs. 40% that sold above the high estimate. Last year, the split was an even 44%-44%. The remainder either sold between the high and low estimate or were not estimated.

The fourth quarter of the year is generally the most prolific in terms of lots offered, with the second quarter the runner-up. That was again the case this year, with 30% of all lots offered in the fourth quarter, 29% in the second quarter. As usual, August was the slowest month, though May outpaced November this past year for the highest number, a reversal of the normal order. 12.3% of all lots were offered in May, 11.4% in November, while only 5.1% were offered in August, the height of summer vacations.

Honors for the highest median prices is usually divvied up between the various branches of Sotheby's and Christie's. This year would have been the same were it not for one exception. Drouot Estimations, not normally known for sales in the paper field, hosted part 5 of the Aristophil sale in June. The Aristophil sale is the outcome of the largest scandal ever seen in the field, an enormous pyramid scheme that bilked investors out of hundreds of millions of dollars. Aristophil was a French enterprise, run by Gérard Lhéritier, aka "the Madoff of Manuscripts." It was like a mutual fund, with 18,000 investors, most small, often putting up life savings, for a promise of a guaranteed 8% per year for five years. He used their money to amass the most amazing collection of autographs and manuscripts imaginable. He purchased several hundred million dollars worth. The problem was, his investors paid over a billion for their shares in them. Lhéritier justified the inflated prices because, by overpaying, investors were pushing up the (perceived) value of their manuscripts. Whenever an investor got cold feet and demanded his money back, Lhéritier paid it with funds received from new investors. Eventually, new funds were insufficient to meet demand, and like all Ponzi schemes, it fell apart. Now the collection is being sold, anticipated for around 15% of what Lhéritier's investors paid, which is still a lot of money, over an estimated 300 sales containing 130,000 manuscripts, in the coming decade. Drouot Estimations offered 96 of these items, of which 30 sold, for a median price of $18,850.

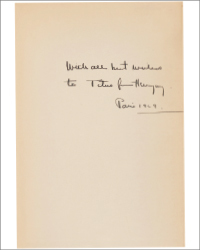

Runner-up was Christie's New York at $15,000, followed by Christie's London - South Kensington at $13,219. The other top priced auctions were Sotheby's, Bonhams, the Arader Galleries, and Ketterer Kunst. At the other end of the spectrum, 12 houses had median prices under $100, the lowest being $14 at the Lancaster Mennonite Historical Society sale, followed by the Alaska Auction at $15. There is still room for collectors of any size budget to enter the field.

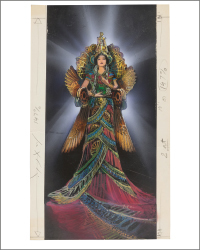

![<b>Sotheby’s, Dec. 16:</b> [Austen, Jane]. A handsome first edition of <i>Sense and Sensibility,</i> the author's first novel. $60,000 to $80,000. <b>Sotheby’s, Dec. 16:</b> [Austen, Jane]. A handsome first edition of <i>Sense and Sensibility,</i> the author's first novel. $60,000 to $80,000.](https://ae-files.s3.amazonaws.com/AdvertisementPhotos/9a74d9ff-42dd-46a1-8bb2-b636c4cec796.png)

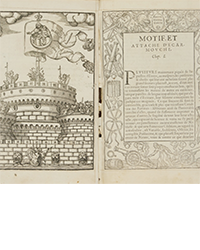

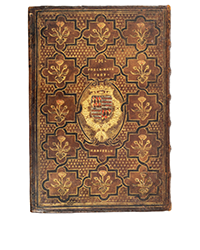

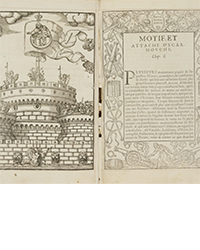

![<b>Heritage, Dec. 15:</b> John Donne. <i>Poems, By J. D. With Elegies on the Author's Death.</i> London: M[iles]. F[lesher]. for John Marriot, 1633. <b>Heritage, Dec. 15:</b> John Donne. <i>Poems, By J. D. With Elegies on the Author's Death.</i> London: M[iles]. F[lesher]. for John Marriot, 1633.](https://ae-files.s3.amazonaws.com/AdvertisementPhotos/8caddaea-4c1f-47a7-9455-62f53af36e3f.jpg)