Rare books hit the news wires in an unflattering way last month. Credit Suisse, the major banking and financial institution headquartered in Zurich, released its annual Yearbook. They spoke of investments, including what they call "non-financial investments" or "investments of passion," or even "treasure assets." Rare books made it into the passionate category, but not to the one of best financial investments. Of course, we are passionately invested in our wives, husbands, and children, but they aren't great financial investments either. Anyone who wants to trade them in for stock certificates has problems at home that go way beyond the scope of this article.

Before we proceed, we should note that this report is aimed at the wealthy, or even ultra-wealthy. That includes an estimated 193,490 (that's a fairly exact looking number for an estimate) people in the world with net assets over $30 million. Most of us fall into the "other" category, which I estimate to be 6,999,806,510. The wealthy are the people who can afford to invest seriously in various sorts of collectibles. Even among them, it is still a small percentage of assets. They estimate these people hold 25% of their wealth in financial assets (stocks, bonds, cash), 24% in real estate investments, 23% in personal businesses, and 16% in real estate they inhabit. Only 6% falls to collectibles.

We should also note that this is focused on long-term investments. You can trade in and out of stocks in the same day, but it's hard to be a day-trader in books or art. Day-traders can make money on the change of a few pennies in a stock price. You cannot do this with a Shakespeare First Folio.

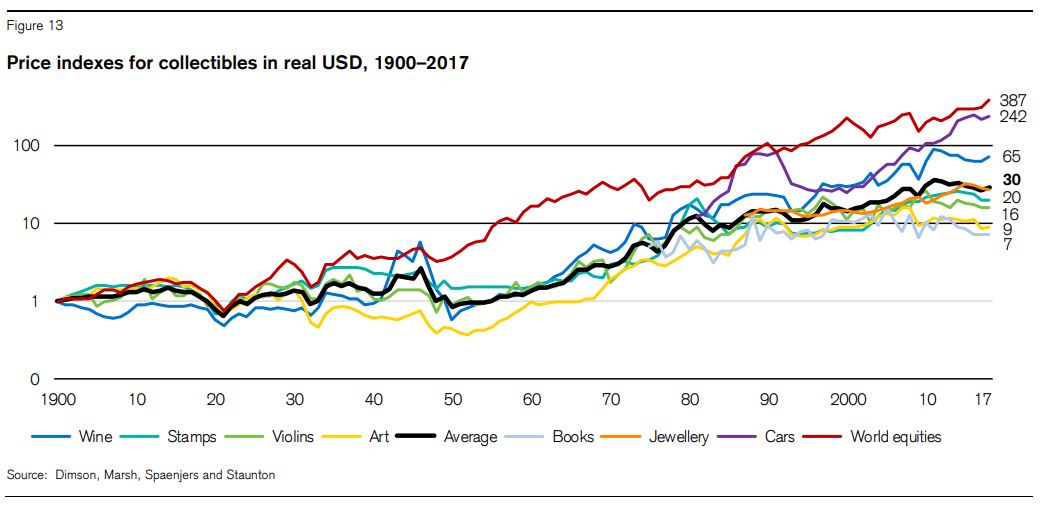

The common wisdom is that stocks are the best long-term investment. That belief has become so ingrained that we would believe it even if it weren't true. Fortunately, we don't have to face such a predicament. Credit Suisse confirms our assumption that equities are the best long-term investment.

However, when it comes to collectibles, they have concluded there is a difference, and here is where they determined rare books are on the short end. The categories they examined were fine wine, classic cars, musical instruments, rare books, jewelry, and stamps. All of these fell short of equities, but within the group, the runaway winner was classic cars. This was followed by wine, jewelry, stamps, musical instruments (as represented by violins), and art. That leaves just books to fill the bottom rung. Credit Suisse describes books as providing a "mediocre financial return."

However, here is where the chart departs from common wisdom. If books have something of a bad rap, art has a different reputation. We have read stories of paintings selling for over $100 million. Anything by Andy Warhol, even prints, just a few decades old, brings huge prices. A piece of paper Picasso used to wipe his paintbrushes would cost as much as an average house. Still, art barely beat out rare books on this index.

Here are a few points Credit Suisse makes in their report about those who purchase "treasure assets."

(1). "In the eyes of the owner, they are beautiful and collectible items, even though they do not generate any financial income." They "provide an emotional reward in terms of enjoyment for the owner."

(2). "Rare books have been a passion investment for centuries."

(3). However, "collectors point to cultural and artistic investment not only as a pleasurable activity but also as a contribution to financial diversification." "[M]ost high net worth collectors say they are interested in the financial as well as the psychic benefits of their private assets. They are not hoarders and accumulators; they are investor-collectors."

(4). "Within the category of passion investments, investors almost invariably hold focused portfolios. The average of their holdings should not be regarded as a desirable allocation for an individual or institution."

(5). "Such investments are in many cases marketable only with a substantial transaction cost, so the purchaser of these tangible assets is likely to be someone with a long investment horizon for whom the liquidity of the asset is a secondary concern."

(6). "The case for private wealth assets is that they provide a mix of wealth conservation, financial diversification, and gratification. We support the view that a moderate allocation to tangible alternative assets is appropriate for high net worth investors."

We will add one more point. Rare books, like equities, is a category of financial asset, but unless you are buying some sort of index fund, you are buying individual items, not an asset class. Stocks may be the best performers, but there's a whale of a difference if you bought tiny Apple or Microsoft in the 1980s, or retail behemoth Sears or the high-flying airlines. In the latter case, you probably lost most if not all of your money. With books, as with stocks, the trick is successfully anticipating which will be more valuable years from now, buying for a fair price, and being patient.

![<b>Scandinavian Art & Rare Books Auctions, Dec. 4:</b> ROALD AMUNDSEN: «Sydpolen» [ The South Pole] 1912. First edition in jackets and publisher's slip case. <b>Scandinavian Art & Rare Books Auctions, Dec. 4:</b> ROALD AMUNDSEN: «Sydpolen» [ The South Pole] 1912. First edition in jackets and publisher's slip case.](https://ae-files.s3.amazonaws.com/AdvertisementPhotos/0a99416d-9c0f-4fa3-afdd-7532ca8a2b2c.jpg)

![<b>Scandinavian Art & Rare Books Auctions, Dec. 4:</b> AMUNDSEN & NANSEN: «Fram over Polhavet» [Farthest North] 1897. AMUNDSEN's COPY! <b>Scandinavian Art & Rare Books Auctions, Dec. 4:</b> AMUNDSEN & NANSEN: «Fram over Polhavet» [Farthest North] 1897. AMUNDSEN's COPY!](https://ae-files.s3.amazonaws.com/AdvertisementPhotos/a077b4a5-0477-4c47-9847-0158cf045843.jpg)

![<b>Scandinavian Art & Rare Books Auctions, Dec. 4:</b> ERNEST SHACKLETON [ed.]: «Aurora Australis» 1908. First edition. The NORWAY COPY. <b>Scandinavian Art & Rare Books Auctions, Dec. 4:</b> ERNEST SHACKLETON [ed.]: «Aurora Australis» 1908. First edition. The NORWAY COPY.](https://ae-files.s3.amazonaws.com/AdvertisementPhotos/6363a735-e622-4d0a-852e-07cef58eccbe.jpg)

![<b>Scandinavian Art & Rare Books Auctions, Dec. 4:</b> SHACKLETON, BERNACCHI, CHERRY-GARRARD [ed.]: «The South Polar Times» I-III, 1902-1911. <b>Scandinavian Art & Rare Books Auctions, Dec. 4:</b> SHACKLETON, BERNACCHI, CHERRY-GARRARD [ed.]: «The South Polar Times» I-III, 1902-1911.](https://ae-files.s3.amazonaws.com/AdvertisementPhotos/3ee16d5b-a2ec-4c03-aeb6-aa3fcfec3a5e.jpg)

![<b>Scandinavian Art & Rare Books Auctions, Dec. 4:</b> [WILLEM BARENTSZ & HENRY HUDSON] - SAEGHMAN: «Verhael van de vier eerste schip-vaerden […]», 1663. <b>Scandinavian Art & Rare Books Auctions, Dec. 4:</b> [WILLEM BARENTSZ & HENRY HUDSON] - SAEGHMAN: «Verhael van de vier eerste schip-vaerden […]», 1663.](https://ae-files.s3.amazonaws.com/AdvertisementPhotos/d5f50485-7faa-423f-af0c-803b964dd2ba.jpg)

![<b>Scandinavian Art & Rare Books Auctions, Dec. 4:</b> TERRA NOVA EXPEDITION | LIEUTENANT HENRY ROBERTSON BOWERS: «At the South Pole.», Gelatin Silver Print. [10¾ x 15in. (27.2 x 38.1cm.) ]. <b>Scandinavian Art & Rare Books Auctions, Dec. 4:</b> TERRA NOVA EXPEDITION | LIEUTENANT HENRY ROBERTSON BOWERS: «At the South Pole.», Gelatin Silver Print. [10¾ x 15in. (27.2 x 38.1cm.) ].](https://ae-files.s3.amazonaws.com/AdvertisementPhotos/fb024365-7d7a-4510-9859-9d26b5c266cf.jpg)

![<b>Scandinavian Art & Rare Books Auctions, Dec. 4:</b> PAUL GAIMARD: «Voyage de la Commision scientific du Nord, en Scandinavie, […]», c. 1842-46. ONLY HAND COLOURED COPY KNOWN WITH TWO ORIGINAL PAINTINGS BY BIARD. <b>Scandinavian Art & Rare Books Auctions, Dec. 4:</b> PAUL GAIMARD: «Voyage de la Commision scientific du Nord, en Scandinavie, […]», c. 1842-46. ONLY HAND COLOURED COPY KNOWN WITH TWO ORIGINAL PAINTINGS BY BIARD.](https://ae-files.s3.amazonaws.com/AdvertisementPhotos/a7c0eda0-9d8b-43ac-a504-58923308d5a4.jpg)

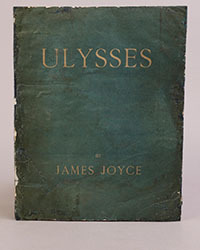

![<b>Sotheby’s, Dec. 11:</b> Darwin and Wallace. On the Tendency of Species to form Varieties..., [in:] <i>Journal of the Proceedings of the Linnean Society,</i> Vol. III, No. 9., 1858, Darwin announces the theory of natural selection. £100,000 to £150,000. <b>Sotheby’s, Dec. 11:</b> Darwin and Wallace. On the Tendency of Species to form Varieties..., [in:] <i>Journal of the Proceedings of the Linnean Society,</i> Vol. III, No. 9., 1858, Darwin announces the theory of natural selection. £100,000 to £150,000.](https://ae-files.s3.amazonaws.com/AdvertisementPhotos/00d5fd41-2542-4a80-b119-4886d4b9925f.png)