Prices of collectible books and related ephemera continue to rise in tandem with the American economy, an analysis of sales at auction from 2014 reveals. Books sold at traditional auction houses (excluding high-volume, low-priced online auctions) saw their prices rise by 5% last year, based on the median price achieved. This follows an increase of 7% the previous year.

The median for 2014 was $423, versus $402 for 2013. As such, that was the second highest overall value achieved, equaling that of 2006. Only 2007, the year before the economic collapse, saw a higher median price reached. After bottoming in 2010, prices have been recovering ever since.

Volume sold at auction is also rising. Over 400,000 items were tracked by the Rare Book Hub last year, with more than 300,000 sold. That represents a little over 50,000 more items offered than in 2013, a little fewer than 50,000 more items sold. This was an increase of 15% in items offered, 18% in items sold.

The sell-though rate was also up, 2% to 74% in 2014, vs. 72% in 2013. This was also the highest number since 2007, and the first time since then that sell-through reached its traditional level of around 75%. At the bottom of this cycle, in 2009, sell-through was only 67%. As with the economy, collector confidence continues to rebound, though not with the “irrational exuberance” of 2007 when prices rose 15% in one year.

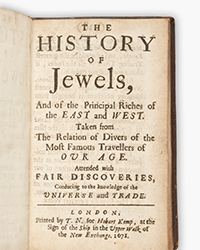

By far the largest volume of sales came from the online sales at Heritage Auctions of Dallas, which features many ephemeral items. They sold over 91,000 items. RR Auctions of Amherst, New Hampshire, also selling online, was second at 11,250. They were followed by more traditional book auctioneers, Bloomsbury of London with 10,989 items sold, Kiefer Buch of Pforzheim, Germany, with 10,223, and Swann Galleries of New York with 9,175. Bonham's would have crossed the 10,000 threshold if all locations (7) were combined.

The highest median price was achieved at Sotheby's in New York at $15,000, followed by Christie's London – King Street at $9,420. These two houses regularly dominate the high end and 2014 was no exception. The top seven positions were held by various locations of Christie's and Sotheby's. The next two were less traditional, on premises auctions held by the Arader Galleries or Guernsey's on their behalf, and bookseller Peter Arnold of Australia. The highest average prices came at Sotheby's New York at $50,038 and Christie's New York at $32,321.

For collectors just starting out, or not quite such high rollers, there were nine houses where the median was under $100. Most notable, in terms of volume, were the Heritage online auctions where over 91,000 items sold with a median price of $94. National Book, Keys, Knotty Pine, and Antiquarian Auctions of Cape Town also had a sizable number of lots under $100, but the prize goes to the auctions held by the Lancaster Mennonite Historical Society where 2,448 lots sold at a median price of $10 and an average price of $21.

Another sign of potential bargains is a very high sell-through rate, an indication that most items are being sold without reserve. National Book Auctions again led the way, along with Alaska Auction at 99%. Aspire, Addison & Sarova, Carlsen Gallery, Dirk Soulis, Robert Siegel Galleries, and Stair Auctioneers all had at least a 95% sales rate, with Heritage Dallas' 91,000 just missing the cut at 94%. Often, these bargains come from auctions in out-of-the-way places, an opportunity for those who search thoroughly and bid online.

Once again, November was the busiest month of the year. A total of 13.2% of the lots were offered during that month alone. However, May has, in effect, become the November of the spring, with 12.7% of the lots offered in that month. The fourth quarter of the year was also again the busiest, with 32.9% of the lots offered, while the second quarter saw 30.3% of the lots offered. However, as more auction houses attempt to reach people at a time when there is less clutter in the market, the off-season continues to grow. The greatest growth occurred in the slowest month – August – where offerings rose by 69%. Last year, August reached the 10,000 mark for the first time. This year, 18,576 lots were offered in the deepest part of the off-season.

When we compiled this report last year, we concluded with a note of caution. Four of the five lowest medians came in the last five months of the year. Did this represent a decline in pricing likely to carry over into 2014? Now we have the answer – no. The highest median prices this time were achieved in the fourth quarter of 2014, with the two highest months being November and December. The year 2014 went out with a bang.

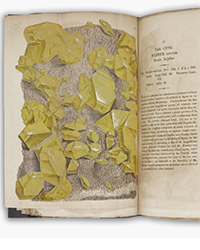

![<b>Heritage, Dec. 15:</b> John Donne. <i>Poems, By J. D. With Elegies on the Author's Death.</i> London: M[iles]. F[lesher]. for John Marriot, 1633. <b>Heritage, Dec. 15:</b> John Donne. <i>Poems, By J. D. With Elegies on the Author's Death.</i> London: M[iles]. F[lesher]. for John Marriot, 1633.](https://ae-files.s3.amazonaws.com/AdvertisementPhotos/8caddaea-4c1f-47a7-9455-62f53af36e3f.jpg)