There was a time when a sale of Borders to Barnes & Noble would have stirred great controversy, perhaps even an examination by the Attorney General for antitrust violations. By the time it happened, it caused hardly a stir. In late September, Barnes & Noble bought the name, website, and customer list and data of the now bankrupt Borders chain. Well, it caused a stir to hardly anyone except the bankruptcy court appointed Consumer Privacy Ombudsman. He felt B&N was not being entirely forthright with Borders' old customers.

While Barnes & Noble didn't have much interest in Borders' stores, perhaps having more than enough of their own, they did want Borders' intangibles. They purchased them from the bankruptcy court for $13.9 million. However, Borders had promised its customers that they would never give their names and data to anyone else. The court therefore required that Barnes & Noble inform Borders' customers that they had purchased their information, but that those customers had the right to stop that data from being transferred to B&N. If they so chose, their customer data would be deleted.

In keeping with this requirement, Barnes & Noble sent out an email to Borders' customers. It was a friendly email from B&N CEO William Lynch. Lynch informed the Borders' customers that, “Our intent in buying the Borders customer list is simply to try and earn your business.” However, he also informed the customers that they had “the absolute right to opt-out of having your customer data transferred to Barnes & Noble.” Customers were told they had until October 15, 2011, to opt out of the transfer of information to B&N. Lynch then concluded his message with, “We hope you'll give us a chance to be your bookstore.”

Consumer Privacy Ombudsman Michael Baxter immediately cried “foul.” Baxter had been appointed by the Court to watch out for the privacy interests of Borders' customers. When the deal was originally put together to sell the Borders' data, Baxter had wanted the message to be an opt-in, not opt-out. In other words, he wanted B&N to obtain affirmative approval from Borders' customers before their data could be transferred, rather than having it transferred automatically if those customers did not say no. To B&N, that may have been a deal killer, as a large number of customers, probably most, were not likely to respond to an email either way. They would not likely opt in if required, nor opt out if they had to either. Most of the 40+ million people in Borders' files could be expected to simply ignore the email.

Baxter backed down on this issue, agreeing to B&N's opt-out rather than fighting for an opt-in. The one concession he was able to obtain was the wording of the e-mail header, which stated simply “Important Information Regarding Your Borders Account.”

However, there were still two other things Baxter did not like about B&N's email, and having conceded on the important issue of opt out, he was evidently not in a mood to back down on a couple of smaller ones. B&N was unwilling to be more accommodating than it had already. The result was a couple of emails flying back and forth between Baxter and B&N before the customer email was sent. It concluded with B&N's attorney saying they had accommodated what they described as Baxter's “only significant comment,” that regarding the wording of the header. Baxter fired back that he would raise his objections with the court if a couple of other changes were not made. B&N ignored his further demands and sent the email as worded. For his part, Baxter did as he promised, filing an objection with the court.

In his objection, Baxter found two faults with the B&N email. First, he found the lack of notification that the email had been ordered by the court to be misleading. Lynch's folksy, friendly email might imply, Baxter believed, that B&N was sending this message as a favor to Borders' customers, rather than because they had been ordered to do so by the court. That, he believed, might make Borders' customers less inclined to opt out. Secondly, Baxter objected to the vague language of a “customer list” being transferred to B&N. Customers might believe all that B&N was obtaining was their names and email addresses, when in fact, B&N was obtaining their entire purchase history. It is easy to imagine a customer who years ago bought a book that might embarrass him today not wanting that information passed on to another company.

So, who won this little skirmish? Well, it appears that Baxter won on one out of two of his objections. However, we doubt that the same is true for B&N, though you would think that would follow from their opponent being one for two. On October 15, Barnes & Noble sent out a follow up email. This one was not so long and folksy. It was a one-paragraph, unsigned, business-like message. Introduced as a “reminder” to the earlier email, it stated with specificity, “The transferred personally identifiable information in the customer list includes customer email address and purchase history.” It added that credit card information was not transferred, and those that wished could opt out by November 2. It did not mention Baxter's other point, that the notice had been ordered by the court, so B&N must have won on that issue.

Nonetheless, we see this as a loss for B&N, not a tie. A couple of bad things happened to them. First, Borders' customers, whose last chance to opt out of the transfer of their data would have ended that day (October 15), got 18 more days to do so. People who might have chosen to opt out, but forgot the earlier email, or maybe never even read it, got a reminder. The greater clarity of this email may drive some people away, but we suspect the simple fact that a second opt-out email was sent will lead to thousands more Borders' customers opting out. B&N could have repeated the exact same email as the first and many additional people would have deselected themselves. It's just the nature of the beast. Each time you give a group of people an opportunity to opt out, some more will do so. Barnes & Noble would have been smarter if, instead of challenging the Ombudsman, they had accommodated his needs in one email. A second email could only lead to more opt-outs, and a smaller customer list for B&N's money.

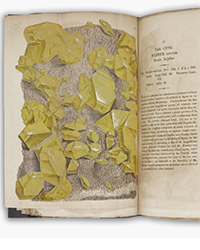

![<b>Heritage, Dec. 15:</b> John Donne. <i>Poems, By J. D. With Elegies on the Author's Death.</i> London: M[iles]. F[lesher]. for John Marriot, 1633. <b>Heritage, Dec. 15:</b> John Donne. <i>Poems, By J. D. With Elegies on the Author's Death.</i> London: M[iles]. F[lesher]. for John Marriot, 1633.](https://ae-files.s3.amazonaws.com/AdvertisementPhotos/8caddaea-4c1f-47a7-9455-62f53af36e3f.jpg)